Embarking on the journey of buying a new car is an exhilarating adventure, but when you're navigating the route with not-so-stellar credit, the path may seem fraught with hurdles. Fear not, future car owners! Armed with the right knowledge and tools, purchasing that shiny new vehicle—even with less-than-perfect credit—is wholly possible. Let's journey together through the roadmap to acquiring a new car with not-so-great credit.

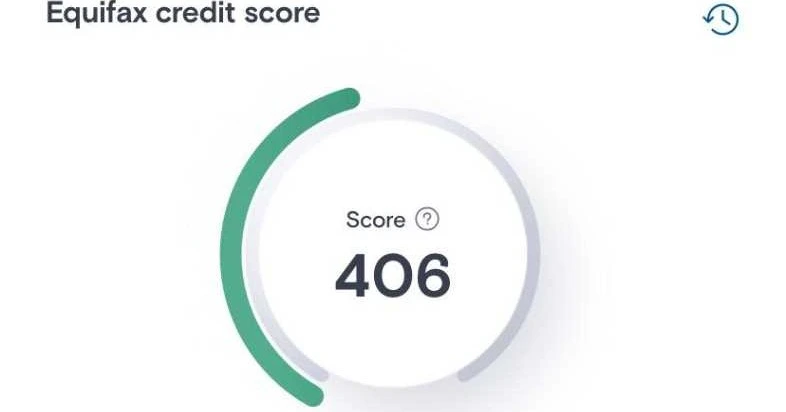

1. Understanding Your Credit Landscape

First and foremost, gain a comprehensive understanding of your credit status.

🔍 SEO Tip: Obtain a free credit report from major bureaus and scrutinize it for any errors or areas requiring attention.

2. Budgeting with Precision

Crafting a realistic and solid budget is your key to navigating through the financial aspects of car buying.

💡 Budgeting Wisdom: Ensure your car payment does not exceed 15% of your monthly net income to maintain a healthy financial equilibrium.

3. Prioritize a Sizeable Down Payment

A substantial down payment not only minimizes your monthly installments but also enhances your approval chances.

🚗 Financial Tip: Aim to save a down payment of at least 20% to alleviate future financial strain and potentially secure better loan terms.

4. Explore Various Financing Options

When it comes to securing an auto loan with bad credit, exploring multiple avenues is paramount.

💼 Financing Insight: From credit unions, banks, to dealership financing, exploring and comparing different loan options will unveil the most feasible path for your circumstances.

5. Consider a Co-Signer

Introducing a co-signer with better credit can enhance your loan approval odds.

👥 Co-Signing Fact: Ensure that both parties understand the responsibilities and obligations attached to co-signing a loan to avoid future conflicts.

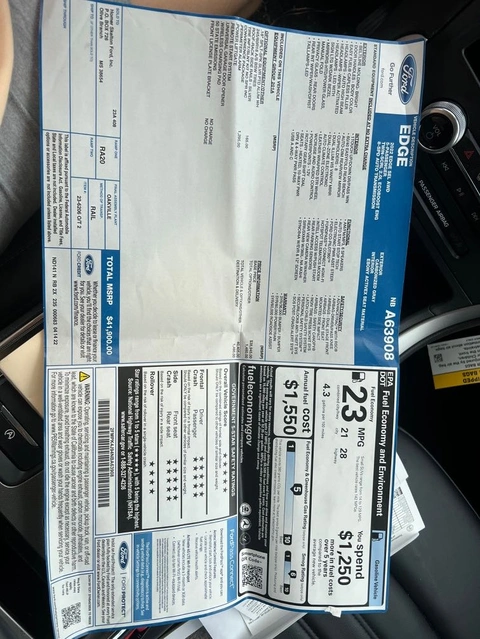

6. Opt for a Reasonably Priced Car

Keeping your sights on a reasonably priced vehicle ensures your loan amount remains manageable.

🚙 Practical Choice: Opting for a new yet budget-friendly model will cater to both, your desire for a new car and adherence to financial sensibility.

7. Navigate Through Loan Terms

Shorter loan terms generally come with higher monthly payments but lower interest rates, saving you money in the long run.

📅 Loan Tip: Assess your budget thoroughly to determine if you can manage higher payments in exchange for a shorter loan term.

8. Reevaluate and Refinance

Post-purchase, keep a close eye on your credit score and financial health with a plan to refinance in the future.

🔄 Refinancing Goal: With improved credit, refinancing can grant you access to more favorable loan terms and interest rates.

In this voyage of car purchasing with not-so-great credit, every step forward, no matter how small, is a victory in securing your new set of wheels. Even as you navigate through the turns and twists of financial challenges, remember: the journey makes the destination all the more worthwhile. With precision, knowledge, and strategic planning, the keys to your new car are well within reach!

Contact me! I would love to help!

Ricardo

(662) 804-3228

Homer Skelton Ford